Back to Part 2.

Part 3: Impact of Taxes and Loan Types

Instead of looking at how much house you can afford based on different conditions, let’s look at two home purchases with two mortgage approaches within neighboring municipalities. These two mortgage approaches are a small fraction of the possible financing strategies; please discuss your individual mortgage needs with your lender or reach out to one of these recommended mortgage professionals.

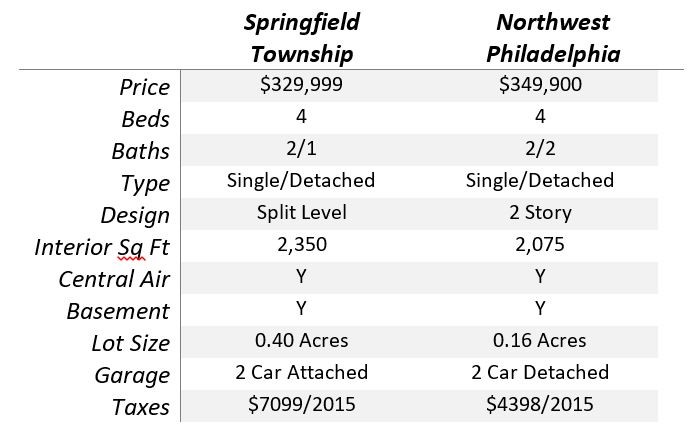

No two houses are alike so it wouldn’t be fair to make up a fictional house and envision how the cash needed to purchase and the monthly payments would compare based simply on varying the municipality. These two subject properties are on the market at the time of writing. They are similar in size and price, but quite different in many other ways.

The Springfield Township Sample Mortgage and Costs

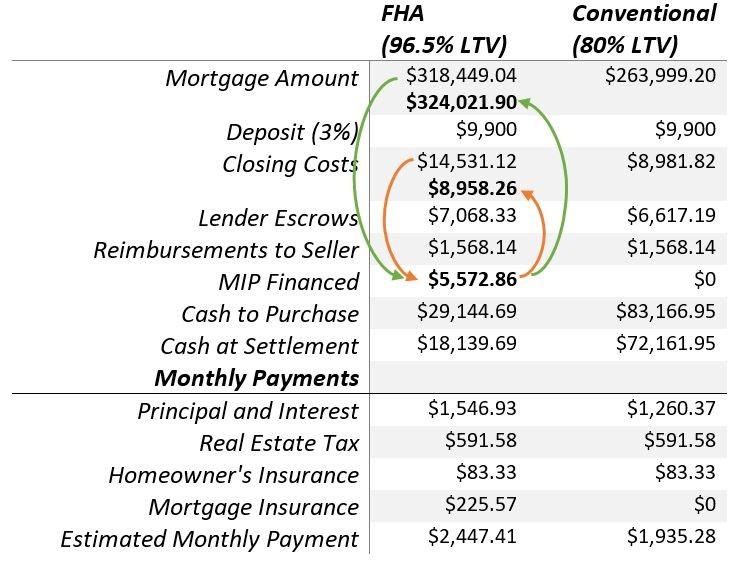

Here we have two very different mortgages and purchase situations for the same home being acquired by someone who can conservatively afford a roughly $2,400/month mortgage payment. In the first situation you have an FHA loan for a purchase with a 3.5% down payment. Closing costs for the FHA loan appear higher, but this higher cost does not require more cash at settlement since the upfront mortgage insurance premium ($5,572.86) is actually rolled into the mortgage amount. (Green arrows show MIP Financed amount increasing the Mortgage Amount while the orange arrows show the MIP Financed reducing the Closing Costs.)

Here we have two very different mortgages and purchase situations for the same home being acquired by someone who can conservatively afford a roughly $2,400/month mortgage payment. In the first situation you have an FHA loan for a purchase with a 3.5% down payment. Closing costs for the FHA loan appear higher, but this higher cost does not require more cash at settlement since the upfront mortgage insurance premium ($5,572.86) is actually rolled into the mortgage amount. (Green arrows show MIP Financed amount increasing the Mortgage Amount while the orange arrows show the MIP Financed reducing the Closing Costs.)

The amount of cash required to purchase with the FHA loan is roughly 1/3rd of that required for the conventional loan with a 20% down payment. There is a significant monthly cost for this in the form of an increase in the principal and interest payment of almost $300 per month as well as mortgage insurance of over $200 per month. This is the cost associated with financing the majority of your purchase when you simply do not have the money saved for the alternative financing method.

The Northwest Philadelphia Sample Mortgage and Costs

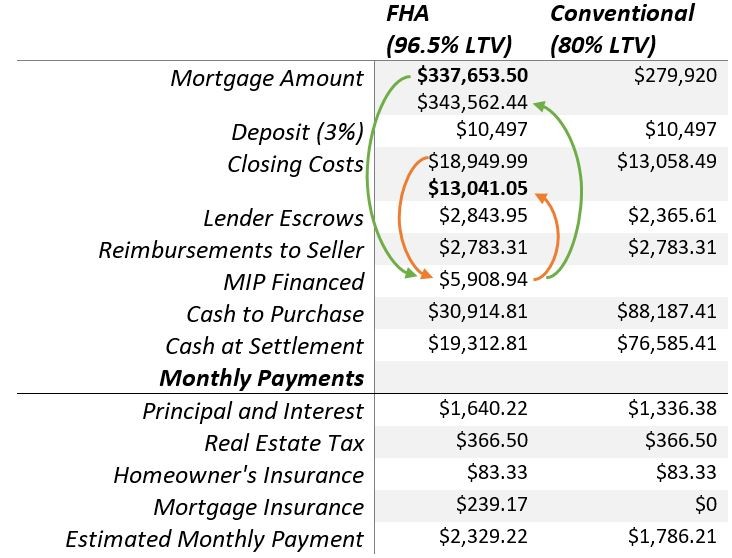

Here we have the cash and monthly payment numbers for the Northwest Philadelphia home. The FHA loan allows you to purchase the home with less upfront cash. Again, this is about 1/3rd of that required with a 20% down payment. The monthly payment is also about $500 higher per month for the FHA vs the conventional with 20% down.

Here we have the cash and monthly payment numbers for the Northwest Philadelphia home. The FHA loan allows you to purchase the home with less upfront cash. Again, this is about 1/3rd of that required with a 20% down payment. The monthly payment is also about $500 higher per month for the FHA vs the conventional with 20% down.

Let’s take a look at what is different between these purchases. The Northwest Philadelphia home is a bit more expensive than the Springfield home, but the monthly payment is less. Looking at the numbers, the Principal and Interest payment is higher, but the real estate taxes are over $200 less per month. The closing costs for the NW Philadelphia home are about $4,000 higher than the Springfield home due to an extra 1% transfer tax. Lender Escrows and Reimbursements to Seller fluctuate depending on where the settlement date falls with reference to when real estate taxes are paid.

Please call or email me today if you are ready to get started, or read on for Part 4.

Cell: 215-520-7166 or Email: neil@realtorneil.com.